Below is the Abstract, Introduction and Conclusions of this important and carefully researched article

The complete article can be downloaded (pdf)

Active Thermitic Material Discovered in Dust from the 9/11 World Trade Center Catastrophe

pp.7-31 (25)

Authors: Niels H. Harrit, Jeffrey Farrer, Steven E. Jones, Kevin R. Ryan, Frank M. Legge, Daniel Farnsworth, Gregg Roberts, James R. Gourley, Bradley R. Larsen

The Open Chemical Physics Journal

Volume 2

ISSN: 1874-4125

doi: 10.2174/1874412500902010007

Complete Article

http://www.bentham-open.org/pages/content.php?TOCPJ/2009/00000002/00000001/7TOCPJ.SGM

Abstract:

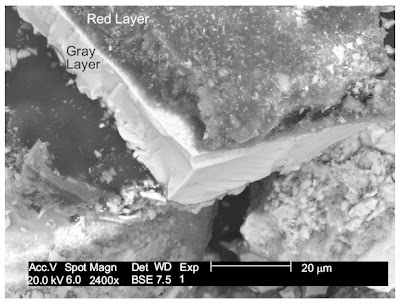

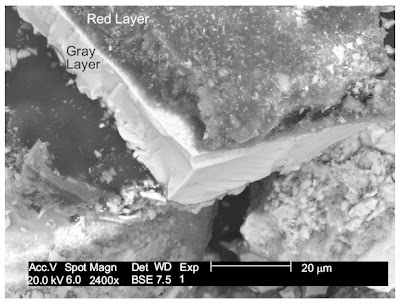

We have discovered distinctive red/gray chips in all the samples we have studied of the dust produced by the destruction of the World Trade Center. Examination of four of these samples, collected from separate sites, is reported in this paper. These red/gray chips show marked similarities in all four samples. One sample was collected by a Manhattan resident about ten minutes after the collapse of the second WTC Tower, two the next day, and a fourth about a week later. The properties of these chips were analyzed using optical microscopy, scanning electron microscopy (SEM), X-ray energy dispersive spectroscopy (XEDS), and differential scanning calorimetry (DSC). The red material contains grains approximately 100 nm across which are largely iron oxide, while aluminum is contained in tiny plate-like structures. Separation of components using methyl ethyl ketone demonstrated that elemental aluminum is present. The iron oxide and aluminum are intimately mixed in the red material. When ignited in a DSC device the chips exhibit large but narrow exotherms occurring at approximately 430 °C, far below the normal ignition temperature for conventional thermite. Numerous iron-rich spheres are clearly observed in the residue following the ignition of these peculiar red/gray chips. The red portion of these chips is found to be an unreacted thermitic material and highly energetic.

Global Research Editor's Note

The definition of thermitic material:

A trademark used for a welding and incendiary mixture of fine aluminum powder with a metallic oxide, usually iron, that when ignited yields an intense heat.

The American Heritage® Dictionary of the English Language, Fourth Edition copyright ©2000 by Houghton Mifflin Company. Updated in 2003. Published by Houghton Mifflin Company. All rights reserved.

Thermite is a pyrotechnic composition of a metal powder and a metal oxide, which produces an aluminothermic reaction known as a thermite reaction. (Wikipedia)

What we are dealing with is the melting/ burning of metal structures.

“Metals are capable of burning under the right conditions, similarly to the combustion process of wood or gasoline. ... A thermite reaction is a process in which the correct mixture of metallic fuels are combined and ignited. Ignition itself requires extremely high temperatures.”

Readers can reach their own conclusions as to the far-reaching implications of these findings.

Although the authors do not address the broader issue of the 9/11 attacks, their findings have a direct bearing on the likely causes of the collapse of the WTC buildings on September 11, 2001. The findings also question the validity of the official report of the 911 Commission.

Below are selected excerpts of the article. Readers can also link to the complete text, by clicking the link

Complete Article

http://www.bentham-open.org/pages/content.php?TOCPJ/2009/00000002/00000001/7TOCPJ.SGM

EXCERPTS

INTRODUCTION

The destruction of three skyscrapers (WTC 1, 2 and 7) on September 11, 2001 was an immensely tragic catastrophe that not only impacted thousands of people and families directly, due to injury and loss of life, but also provided the motivation for numerous expensive and radical changes in domestic and foreign policy. For these and other reasons, knowing what really happened that fateful day is of grave importance.

A great deal of effort has been put forth by various government-sponsored and -funded investigations, which led, in large part, to the reports released by FEMA [1] and NIST [2]. Other studies of the destruction have been less well publicized but are no less important to the outstanding obligation that remains to the victims of that tragedy, to determine the whole truth of the events of that day [3-10]. A number of these studies have appropriately focused attention on the remaining physical material, and on available photographs and video footage, as sources of evidence still in public hands, relating to the method of destruction of the three skyscrapers.

CONCLUSIONS

We have discovered distinctive red/gray chips in significant numbers in dust associated with the World Trade Center destruction. We have applied SEM/XEDS and other methods to characterize the small-scale structure and chemical signature of these chips, especially of their red component. The red material is most interesting and has the following characteristics:

1. It is composed of aluminum, iron, oxygen, silicon and carbon. Lesser amounts of other potentially reactive elements are sometimes present, such as potassium, sulfur, lead, barium and copper.

2. The primary elements (Al, Fe, O, Si, C) are typically all present in particles at the scale of tens to hundreds of nanometers, and detailed XEDS mapping shows intimate mixing.

3. On treatment with methyl ethyl ketone solvent, some segregation of components occurred. Elemental aluminum became sufficiently concentrated to be clearly identified in the pre-ignition material.

4. Iron oxide appears in faceted grains roughly 100 nm across whereas the aluminum appears in thin platelike structures. The small size of the iron oxide particles qualifies the material to be characterized as nanothermite or super-thermite.

5. Analysis shows that iron and oxygen are present in a ratio consistent with Fe2O3. The red material in all four WTC dust samples was similar in this way. Iron oxide was found in the pre-ignition material whereas elemental iron was not.

6. From the presence of elemental aluminum and iron oxide in the red material, we conclude that it contains the ingredients of thermite.

7. As measured using DSC, the material ignites and reacts vigorously at a temperature of approximately 430 °C, with a rather narrow exotherm, matching fairly closely an independent observation on a known super-thermite sample. The low temperature of ignition and the presence of iron oxide grains less than 120 nm show that the material is not conventional thermite (which ignites at temperatures above 900 °C) but very likely a form of super-thermite.

8. After igniting several red/gray chips in a DSC run to 700 °C, we found numerous iron-rich spheres and spheroids in the residue, indicating that a very high temperature reaction had occurred, since the iron-rich product clearly must have been molten to form these shapes. In several spheres, elemental iron was verified since the iron content significantly exceeded the oxygen content. We conclude that a high-temperature reduction-oxidation reaction has occurred in the heated chips, namely, the thermite reaction.

9. The spheroids produced by the DSC tests and by the flame test have an XEDS signature (Al, Fe, O, Si, C) which is depleted in carbon and aluminum relative to the original red material. This chemical signature strikingly matches the chemical signature of the spheroids produced by igniting commercial thermite, and also matches the signatures of many of the microspheres found in the WTC dust [5].

10. The carbon content of the red material indicates that an organic substance is present. This would be expected for super-thermite formulations in order to produce high gas pressures upon ignition and thus make them explosive. The nature of the organic material in these chips merits further exploration. We note that it is likely also an energetic material, in that the total energy release sometimes observed in DSC tests exceeds the theoretical maximum energy of the classic thermite reaction.

Based on these observations, we conclude that the red layer of the red/gray chips we have discovered in the WTC dust is active, unreacted thermitic material, incorporating nanotechnology, and is a highly energetic pyrotechnic or explosive material.

(emphasis added)

Complete Article

http://www.bentham-open.org/pages/content.php?TOCPJ/2009/00000002/00000001/7TOCPJ.SGM